Home » 3 Steps to Evaluate Your SaaS Pricing Strategy

3 Steps to Evaluate Your SaaS Pricing Strategy

Laura Beussman

Director of Marketing, Blackbaud

If you work in product, portfolio or solutions marketing, you’ve probably received this email a dozen times. You know the one—the one that says, “our pricing strategy isn’t working. We need to kick off a project to evaluate our pricing model.” Even if you love a good pricing project, like I do, this is an email that makes you sigh. What, exactly, isn’t working with our current pricing strategy? Is it what we’re charging the customer (price point)? Or is it how we’re charging them (price metric)? Or is it the way we’re bundling together different features when we go to market (packaging)?

If your current pricing strategy is negatively impacting sales, it’s time to assess your price point, packaging, and price metric.

Step 1: Evaluate Your Price Point Against Competitors

We’ll start here, because an inexperienced pricing manager will start and end a pricing project by looking at price points. Of course, price point is critical. The “sticker” price is the first thing a potential customer sees, and if your pricing is significantly higher or lower than the competition, this could be making things harder for sales. However, looking at price points in isolation are meaningless, when you might be comparing apples and oranges.

Before you get too smug (“there’s so much more value in our offer!”), make sure you’ve done the work to justify your price point. At the end of the day, what matters is if there’s enough value in your offer to justify your price point. Build the value bridge, step by step, to walk up or down from your competitor’s price point. These may be intangibles (assigning value to things like “better support” or “ease of use”) and will require making some assumptions, but going through the exercise is critical. However, if, after comparing yourself to the competition and evaluating the value you’re bringing your market, you feel confident your price points make sense, it’s time to evaluate packaging.

Step 2: Reassess the Features in Your Core Package

It’s time to dig in deeper to look at your packaging, or the way you’re bundling together different features when you go to market. It’s easy for packaging to get off kilter in a mature solution. The team spends a lot of time and energy developing a new capability or feature, and everyone agrees it should be an upsell. Then this happens again. And again. Before long, you have a laundry list of add-ons, all of which were developed at different points of time and not necessarily compared to each other.

Or, perhaps you’ve been bundling in new capabilities to your core offer to ensure everyone adopts them, and increasing the total price with each new capability because they are SO VALUABLE (and you believe in value based pricing!).

There are features that everyone wants and there are features that are highly valuable to a small segment of your market.

An ideal pricing model strikes the balance of only charging each customer for the pieces they are willing to pay for and making offers easy to sell, position and understand.

Even if you’re confident that your pricing is simple and you’ve identified the right features to include in the core offer and the right features to have as up-sells, if you’re not segmenting your pricing by the right metric, it won’t resonate with your buyers. And that brings us to our third deliverable to keep in mind.

Step 3: Ensure Your Price Metric is Tied to Customer Value

Your price metric, whether records or users or % of transactions, is what allows you to segment your customers by their willingness and ability to pay more or less. The right price metric ensures that the customers that are getting the most value AND have the most resources are paying the most.

The piece that people often forget is that a good price metric also segments in a way that will be well received by the market. Let people pay in the way that they want to pay. If your price points seems to be right for certain segments of your market, and yet wildly off in others, you may have a price metric issue.

When evaluating your pricing metric, listen for words that the market uses to describe themselves and their complexity.

Starting your pricing project with all three of these components in mind will help you avoid getting fixated on one lever (“drop the price!”), and also help you keep your stakeholders from doing the same.

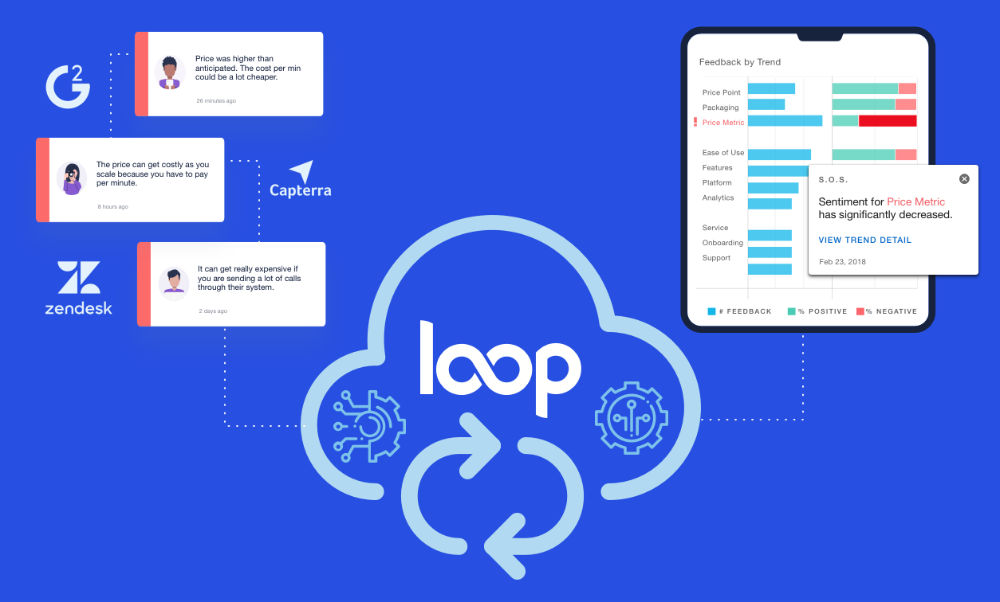

See how Loop can help you monitor when customer feedback trends about your software pricing reach a significant level that requires attention, so you can react in almost real-time.

Laura Beussman is passionate about product marketing, pricing and offer strategy. Currently, as director of marketing of faith solutions at Blackbaud, Laura leads the go-to-market strategy for Blackbaud’s portfolio solutions for faith communities, which includes defining the packaging and pricing strategy for new and existing solutions, as well as the segmentation, buyer personas, positioning, value prop and content development.