Home » NPS: It’s in the Feedback, Not the Score

NPS: It’s in the Feedback, Not the Score

Madeline Turner

Net Promoter Score (NPS) has become a key performance indicator of customer loyalty and success across fortune 1000 businesses. More than two-thirds of these companies use NPS to gauge a customer’s likelihood of sticking around and referring your business to others.

While the NPS score provides us with a high-level indicator of customer satisfaction and company performance, the true value is in the feedback behind the score. For this number to truly be used to enhance the customer experience, it’s critical to analyze open-ended questions as part of your NPS survey.

What is NPS?

NPS, or Net Promoter Score, is a ranking system based on survey responses sent to a company’s customers, often using a point scale alongside a few simple survey questions. The goal with NPS responses is to create a metric that can be used to measure customer happiness in real-time, allowing agile companies to positively affect customer churn by reducing the number of unhappy customers.

What is a good NPS Score?

‘Good’ is a relative term when it comes to sizing up your overall NPS score. Broadly speaking, you can likely research industry or more generic scores to find a starting goal, but note that a number of factors play into how your score compares. For example, newer companies may not have a high enough response rate to their NPS questions, which will likely lead to inaccurate results. Additional factors include the net promoter system or NPS tool used, the question(s) asked and variations between your product and others in your space.

So while it’s worth knowing what the standards are in your industry, set your own goals once you have enough responses, and stick to simple questions – or a single question that stays consistent throughout the campaign.

Why you should prioritize the qualitative feedback over the NPS score

Think of it this way: Your net promoter score is a stoplight telling you whether to keep pushing forward, prepare to brake, or halt. The qualitative feedback behind the score is your navigation device—providing direction and a path forward. It’s your responsibility to pay attention to the signs and alerts.

Sure, you can track growth or decline of a number over time, but what is that number really telling you if you aren’t able to put context to the rise and fall? In addition to asking customers whether or not they’re likely to recommend your company or product, ask them about their experience.

Understanding the qualitative feedback driving the Net Promoter Score will provide guidance as to whether you should start, stop, or continue dedicating resources to specific initiatives. Without an understanding of the experiences influencing the score, we can only make educated guesses about our customers’ experience with our product or services. As Jeff Breunsbach from Customer Imperative states, “the scores are important, but the comments are the real goldmine.”

How to understand the customer feedback behind the score

To get to the heart of what’s impacting your score, Andrew Chen recommends analyzing comments and categorizing each comment into primary promoter benefit or detractor categories. The categories will be initially deduced by reading every single comment and coming up with the large themes across them.

Chen acknowledges that the practice of reading every comment can be daunting as “there is no substitute for the product team digging in and really listening directly to the voice of the customer and how they articulate their experience with your product.”

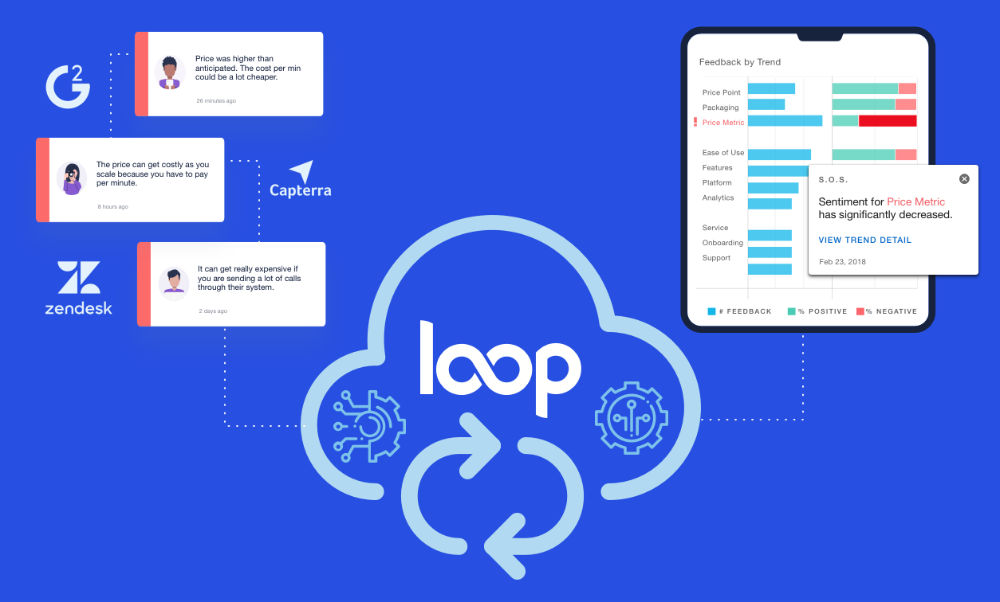

Good news, though. There is, actually, a substitute for reading every single piece of NPS data. Using natural language processing, Loop is eliminating the manual effort that was previously required to extract meaningful insights from customer feedback, so that CX and marketing leaders can proactively identify issues impacting retention and sales, and pivot company initiatives to address them.

How Loop simplifies customer feedback analysis

With NLP, Loop buckets your feedback into ten key SaaS topics: Price Point, Packaging, Price Metric, Ease of Use, Features, Platform, Analytics, Service, On-boarding, or Support. This way, you can focus on identifying the valuable insights in customer feedback impacting your NPS score rather than spending energy guessing or searching for the why.

Once you’ve identified a topic trend (such as price metric and packaging in the above example), you’re then able to focus your efforts on that feedback trend, specifically. And, if you’re conducting regular NPS surveys, you can monitor the trends in feedback over time, giving you a complete view into how feedback related to specific topics are changing.

Rather than combing through all of your data, you can look specifically at the verbatim feedback related to a topic, like a price metric. In this example, we’re able to uncover that the top drivers of negative feedback related to price metric were related to being charged for email addresses, regardless of whether or not the contacts are being engaged with. This is information that this particular company can act on.

How to action on qualitative NPS feedback

As companies strive to build better Customer Experience programs and make the voice of the customer integral to business decisions, success depends on our ability to act on the feedback we’re already receiving from our customers.

Once we understand what needs to be addressed, we can start doing something about it.

Taking action on feedback will require five things:

- Alignment across the organization. A voice of the customer program is only successful if there is buy-in that customer feedback isn’t a nice to have. It’s your guide.

- Accountability for the customer experience. If trends indicate that customer support is unresponsive or on-boarding was complicated, we have to own this. Regardless of whether or not we feel our teams’ efforts warrant the feedback received, it’s the customer’s reality. We own that truth.

- Giving customers a seat at the table. If your NPS score is low because of dissatisfaction with your product and its features, it’s time to dig into what’s missing with follow-up questions. Ensure that this feedback is taken into account as you prioritize roadmap decisions.

- Proactive communication. If your customers are taking the time to share valuable feedback with you about their experience with your company or product, follow up. Acknowledge the feedback and tell customers what your plans are for addressing poor experiences or enhancing the features they love.

- Actual action plans. Not a checklist or email updates. You need specific initiatives with defined success criteria. What does it look like to fix the problem and reduce churn, who are the stakeholders and executors, and what’s the timeline?

The Net Promoter Score isn’t dying or antiquated. A new methodology won’t be the key to our success. The value is in the details of the score, and the responsibility to decipher what those details mean in regards to the customer journey is on u