Home » Unlocking Growth Opportunities with Needs-Based Segmentation

Unlocking Growth Opportunities with Needs-Based Segmentation

Lauren Culbertson

Co-founder and CEO, LoopVOC

There are endless ways to create a successful growth strategy, from finding new markets to serve, to building new products to sell, to launching new channels to deliver value to customers on their terms. But the foundation for a high-impact growth strategy comes down to one core truth: knowing your customers and the needs of the market you serve.

When leaders lose sight of this truth, execution falls short. Too often, we focus on a broad understanding of our customers and fail to get into the details that matter, like how needs vary amongst different types of customers and how well we serve each of those needs as a company.

We miss out on growth opportunities because we do not clearly understand our most valuable customer segments. And without understanding we cannot clearly position our value, nor can we build roadmaps that resonate with the problems our customers are trying to solve. When market needs and competitive environments change, we fall short.

Customer needs are changing constantly, and a cohesive segmentation strategy is critical to delivering value.

Many of us know we need to take a targeted approach to stay relevant, but we often don’t have the insights we need to deliver. The data we need to understand our customers lives within our functions, and not across. As a result, our go-to-market, roadmaps, and sales strategies remain siloed and irrelevant.

Even when we are lucky enough to have access to the data required to build highly-targeted growth strategies, we commonly focus too much on the firmographic traits of our various customer segments, and not enough on how their needs vary. Understanding the distribution of different groups of customers is interesting, but segmentation is not actionable unless we understand their needs and how they find us valuable.

Needs-based segmentation takes a unique approach to unlocking growth opportunities by classifying customer segments based on a common set of needs and behaviors.

That starts with understanding how different groups of customers find us valuable, and extends into identifying new market segments with unmet needs that could become customers with new or existing solutions.

How to drive growth with a needs-based segmentation strategy:

- Segment customers based on common needs and how well you’re meeting them.

- Identify shared characteristics within each segment using firmographic and financial data.

- Define the strategies for driving growth in each segment.

- Adjust go-to-market tactics by segment including positioning, roadmap, channels, and offers.

- Launch, test, measure, and refine strategies based on key performance indicators.

1. Segment customers based on common needs and how well you’re meeting them.

Sometimes we have been in a market for so long that we like to think we know what our customers need and fail to refresh and evolve our thinking. That is why it is critical to start segmentation with an exercise in deeply understanding customer and prospect needs.

Analyze feedback you’re already getting.

Customers often tell us what they need in the feedback they give us in online reviews, call transcripts, sales opportunity notes, and NPS survey responses. Looking at broader industry data is also important, but it is important to find agile sources of feedback so that you can continue to monitor and test things in real time.

Identify the most common needs coming out of the feedback.

As we analyze feedback from customers to form segments, we can start with understanding the words customers use to describe their needs. As you read through verbatim feedback, look for answers to the following questions:

What did the customer hire you to do?

What is the business challenge they are looking to solve?

What do they need today and how might that change in the future?

Some examples of customer feedback uncovering needs might look like:

[a CRM opportunity note]: Need call attribution for online channels – zillow, FB, insta and website – 80 leads from digital efforts, about 40 of them are calls, no visibility into what is performing best – need a call tracking platform to optimize his marketing spend.

[an NPS survey response]: I just need to record calls for my clients – I’m not focused on marketing attribution at the moment.

[an online review]: I wanted to know what’s working to drive qualified leads, make informed marketing decisions and generate more revenue.

Quantify how often needs come up across your feedback sources.

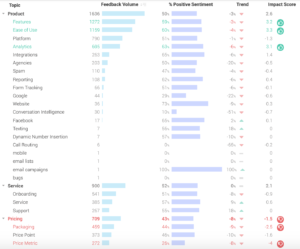

To identify the biggest needs-based segments, it is important to look for data that shows a quantifiable theme. The chart below shows how we can use volume to highlight the segments with the largest needs. One enterprise customer shouldn’t dictate changes to our go-to-market strategy. Needs-based segmentation helps us to avoid over-focusing on the loudest in the room, and instead build strategies based on the largest pools of voices.

Measure how well we are meeting needs.

Once we understand what customers need from us, we need to understand those needs we solve well (strengths), those we do not (weaknesses), and those unmet needs that are becoming more important (threats). We will use these insights to group customer segments and identify growth strategies that focus on how each unique group derives value from our company.

In order to identify strengths, weaknesses, and threats we first must understand the impact associated with the needs we’ve uncovered. The changes we make should tie directly to the outcomes that matter most, so every need should be associated with a metric that can indicate how our ability to meet the need will impact our own results. Does solving the need mean we will win more business? Will our customers be more satisfied? The best feedback is tied to metrics like new sales, retention, and brand sentiment.

For example, win/loss interviews and opportunity notes can provide feedback around needs and measure the impact of the need by sales dollars won or lost. Similarly, NPS and churn survey feedback can indicate needs impacting retention, and online reviews can uncover needs measured by brand sentiment. When feedback is tied to metrics, we can uncover the needs with both the highest frequency and impact, as shown in the chart below.

Identify strengths, opportunities, and threats.

Once we understand impact, we can identify strengths, weaknesses, and threats.

Strengths are the need segments with the most positive impact as measured by revenue, retention, or sentiment. Strengths help us to understand the segments of customers that are deriving the most value from us today. These are the customers we want to protect and expand with our product and offerings. Some examples of customer feedback uncovering strengths might look like:

[Service]: The team is very responsive and are always willing to listen to feedback and make changes to the platform when they make sense. The Customer Success Managers always treat us like we’re their number one customer and I don’t doubt that they do that for all of their customers.

[Support]: My client had an emergency that they accidentally cancelled a number that was still in use. I was really happy to have the Priority support email and the number was able to be restored within 3 hours after the support center opened for the day.

[Ease of Use]: My favorite part of the platform so far is how easy it makes listening to specific parts of calls. The time stamps for specific words streamlines the process of listening to a lot of calls, which can be tedious and time consuming.

Weaknesses are need segments with the most negative impact as measured by revenue, retention, or sentiment. Weaknesses help us to understand the segments of customers that are deriving the least value from us today. They are also often areas where our competitors outperform us. These are the customers we want to expand our product and go-to-market to serve, because they have the highest potential impact on our business. Some examples of customer feedback uncovering weaknesses might look like:

[Features]: Lack of SMS text messaging features. No white-labeled reporting for client export. No direct integration with WishPond, though I can accomplish via Zapier. Sometimes local numbers in a limited area can be difficult to partition.

[Platform Stability]: numerous technical issues since launching in may alone.

[Packaging]: I think the cost is a bit high in some instances, and the account tiers can be extreme when trying to gain access to certain features or integrations. Not good.

Finally, Threats are the need segments with the biggest decline in impact as measured by revenue, retention, or sentiment. Threats can come from needs that have historically been strengths, but that customers have been increasingly complaining about. Threats can also be needs that have always been unmet, but are now increasingly desired. It is important to pay attention to threats to understand the segments that are changing as these are most vulnerable to competitive pressure.

When you have analyzed your segments, you will be left with your top needs-based segments, as illustrated in the LoopVOC dashboard below.

Segment 1: Value Prop Strengths (Needs = Service, Support)

Segment 2: Value Prop Weaknesses (Needs = Integrations, Platform, Packaging)

Segment 3: Value Prop Threats (Needs = Ease of Use)

Check out this reporting template to create your own version of this dashboard.

2. Identify shared firmographic traits within needs-based segments using firmographic and financial data.

Once we’ve identified our top needs-based segments, we can move on to understanding common traits within each segment that we can use to target our tactics. Drill into each customer needs-based segment to understand the shared characteristics, such as:

Firmographic data (industry, vertical, size)

Persona data (use case, role, job title)

Customer type (new customer vs existing)

Products and Offerings (enterprise vs self serve)

Customer Lifecycle Stage

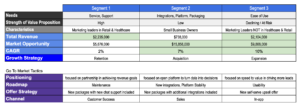

3. Define the strategies for driving growth in each segment.

Once we understand common characteristics, we can extrapolate the size of each segment based on performance indicators, such as percentage of overall revenue, growth rate, and market opportunity. This sizing enables us to identify the primary growth strategies for each segment, which will then lead to the tactics we use to drive each strategy.

Acquisition strategies are targeted toward securing new customers and are often leveraged in segments with a high CAGR and/or total market opportunity. Segment 2 in the chart above represents an acquisition opportunity where the company has low market penetration because they are not yet solving the desired need of the segment. Assuming the costs of acquisition are low enough, the opportunity is attractive because the segment is growing fast. The tactical conversation should focus on what aspects of product, positioning, pricing, and overall go-to-market would need to change to meet the segment’s desired needs.

Retention strategies are targeted toward keeping existing customers and are often leveraged in segments with a high percentage of overall revenue. Segment 1 in the chart above represents a retention opportunity where the company has high volume of customers and have proven success in meeting the desired needs of service and support. Retention is important here because the segment makes up such a large percentage of overall revenue, but the overall market growth rate has slowed down. The tactical discussion in this scenario should focus on which aspects of service should evolve to continue to meet the needs of this very important segment.

Expansion strategies often represent a hybrid of acquisition and retention and are focused on selling additional products and services to existing customers. In the chart above, Segment 3 represents an expansion opportunity because it makes up a high percentage of overall customers, but also has a large market opportunity and fast growth rate. This means that there is an opportunity to expand customers in this market by improving on the need at risk, which is ease of use. The tactical conversation for this segment should focus on product and positioning to increase positive perceptions of this need.

4. Adjust go-to-market tactics by segment including positioning, roadmap, channels, and offers.

After we’ve defined the growth strategies of each segment, we are ready to determine the tactics required to achieve our strategic goal. In this example, we will break down the tactics of each segment by positioning, product roadmap, offer strategy, and channel.

Positioning tactics should focus on the needs of each segment, and can be either offensive or defensive in nature. Offensive positioning works best in segments where the value proposition is strongest, such as Segment 1 in the example above. Here you can use positioning based on the words your customers use to describe how you solve their problems and needs. Defensive positioning can be used to overcome weaknesses and threats, as illustrated in Segment 2. In this scenario, if integrations are important, but the product does not have a great experience for delivering them yet, you might consider positioning the value of hands-on service to help customers get the data connections and end results they need. It is very important to set the right expectations with positioning, as this is what guides the entire experience and outcomes a customer achieves by doing business with your company. Avoid the temptation to position yourself ahead of your product, or you will find yourself with a churn problem that won’t be worth the price.

Product Roadmap is one of the most important ways to show innovation and build trust with each customer segment. Prioritization is often the biggest challenge with managing roadmaps, and segmentation can help to keep the focus on what will have the biggest impact. Product managers can use this framework to understand what to build by focusing on the gaps with the biggest growth potential, and de-prioritizing work that is not relevant to the most important segments. Marketing teams can also understand the most powerful ways to launch and communicate new product capabilities to the segments where they are most relevant. Segmentation enables a seamless connection between product management and marketing teams to understand what features are needed most and how they should be communicated to build the most excitement in the market. (Learn more about how to use voice of the customer to transform product roadmaps).

Offers and promotions can also be used to meet the needs of customer and market segments. In the example above, packaging is a critical need of Segment 2, but the company is not delivering on that need. This could be from prackaging the wrong features or usage drivers together, such as limiting user licenses in lower packages which ends up blocking adoption. If cross-functional usage is key to achieving value, this limitation in the packages would result in a poor experience and unmet need when it comes to how the segment prefers to buy. Another packaging tactic for this segment would be increasing the number of integrations included in various packages, as this is a critical feature to the segment and would increase access to value.

Channels are the ways in which your market can purchase and experience your products and offers, whether that be through frontline sales and customer success teams, partners, or your own applications. Channel strategy is critical to ensure you are selling the right solution to right the person with the right message. If you have a direct sales team, you would focus them on Segment 2 as this is the biggest opportunity for acquisition. When direct sales is a channel, focus on enablement around the ideal customer profile, needs, qualification criteria, and objection handling for value proposition weaknesses For Segment 3, an in-app purchasing experience could be the strongest channel to showcase ease of use through the buying process.

5. Launch, test, measure, and refine strategies based on key performance indicators.

Once we launch our go-to-market initiatives by segment, it is critical to test and make sure they are achieving the intended growth outcomes (acquisition, retention, and expansion). For bigger changes it is often appropriate to test positioning and offers with customers to get feedback, and for incremental changes we can closely monitoring performance to understand any necessary refinements. Continuing to stay connected with customers and prospects to evolve which segments are most critical to growth is of the utmost importance.

We also want to understand how our strategies and tactics are impacting our strengths, weaknesses and threats, as this will determine our next set of priorities. For each segment, measure the impact of new sales, retention, and brand sentiment before and after changing go-to-market efforts. This can be tied to regular reporting that is shared across departments to create alignment across product management, sales, marketing, and customer success. Each department should have access to the insights they need to make specific and actionable changes as necessary. Information can be shared via meetings or email newsletters, but it is importance to have a regular cadence to bring go-to-market teams together to discuss feedback, signals, and themes that could impact needs-based segmentation strategies. This gives every group a chance to buy in to strategy and push forward company success, which is the ultimate win.